What is Swing Trading?

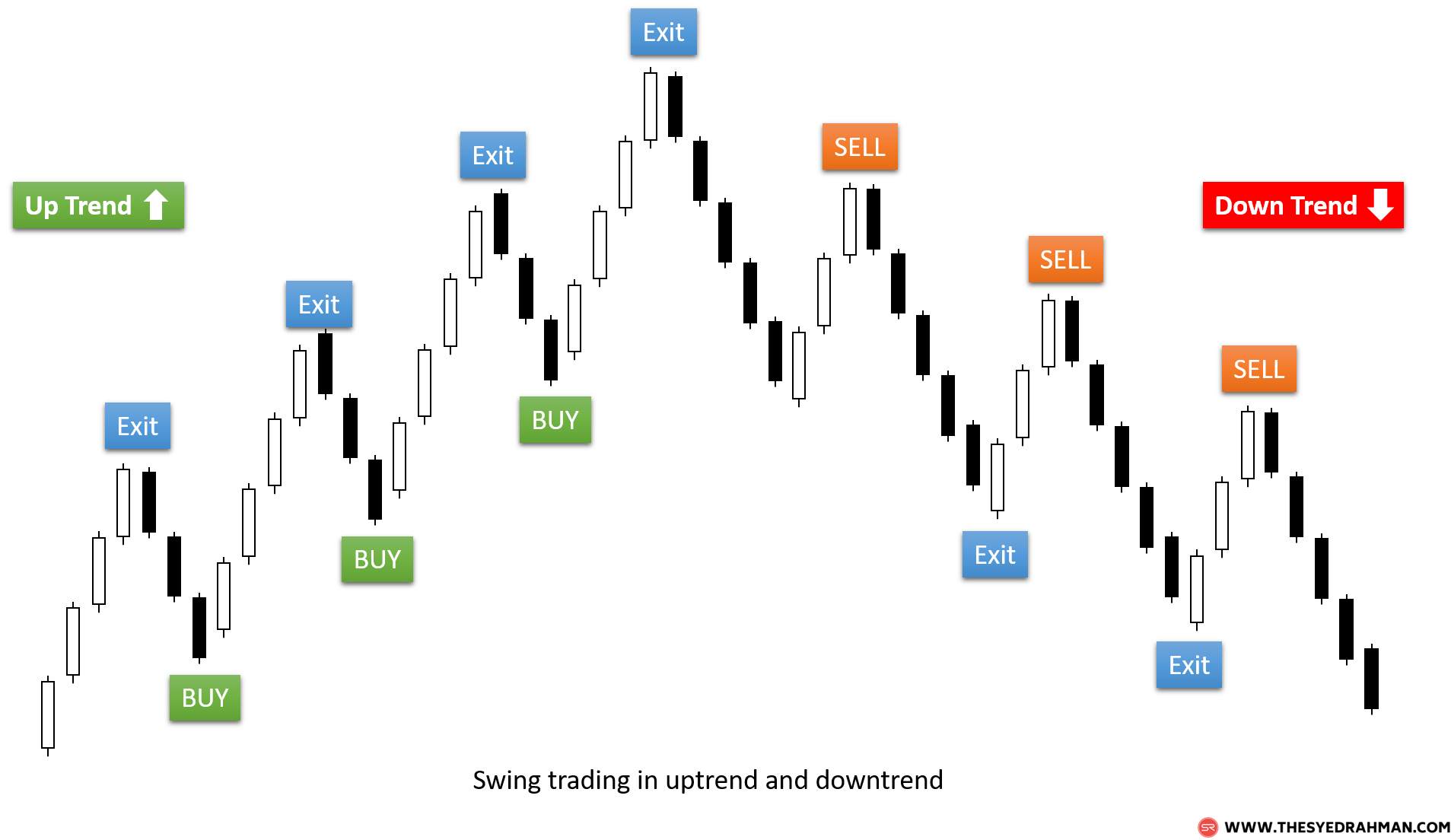

Swing trading is the style of trading the trend of a stock, currency or any other financial assets using various tools of technical analysis, which includes the chart patterns, candlestick patterns, and momentum indicators. Swing trading is also referred as the momentum trading, since a swing trader tries to detect the swing high or swing low of a stock to open a trade position at the very beginning of a trend’s movement, either it’s an uptrend or downtrend in the market. Swing traders solely depend on the technical analysis only and are rarely concerned with fundamental analysis of a stock, commodity, currency, etc.

Swing traders hold a trade position for relatively longer period of time than the other types of technical traders like day traders, scalpers who hold a trade position for shorter times which in most cases a few minutes to one day. In general, swing traders hold their trade position for 2-3 days to a couple of weeks depending on the timeframe and trends longevity.

What is a Swing Point in a chart?

In a trending market, whether it’s an uptrend or downtrend, the price goes into a specific direction, or maybe we can say at the current trend direction, by continuously making the tops and bottoms.

These all the tops and bottoms are the swing points of a trend. If a top of a trend is a valid top, then we call this as valid swing point, and if the top is invalid top, then we call this as invalid swing point. Likewise, if the bottom is valid then we call this a valid swing point, and if the bottom is invalid, then we call this as invalid swing point. So, all the tops and bottoms, either they are valid or invalid, we will call these swing points. But to recognize these swing points as their state of formation, we call the top swing points as swing high, and, the bottom swing points as a swing low.

These swing points are the most important levels because there we make the trading decisions like whether we should take a long (buy) trade entry or a short (sell) trade entry. These levels or swing points are also important to get out of a trade at the right time by taking the profits. In swing trading, traders try to detect the formation of these levels to get in or out of the market to get maximum profit and minimize the loss size.

Swing Trading vs Day Trading Vs Position Trading Vs Scalping

There are mainly 4 different trading types which are being followed by the traders. These are the

• Swing trading

• Day trading

• Scalping

• Position trading.

In which swing trading is the most famous, reliable and profitable style in technical analysis to predict the potential swing high or swing low to capture the start of a trend continuation moment to trade Forex, Stocks, Commodities or any other financial assets.

In day trading and scalping, traders usually hold a trade for a very short amount of time. In scalping, traders hold a trade position for a few minutes to an hour, and in most cases, scalpers use the smaller chart timeframes like 1 minute to 15-minute charts to analyze the market movement.

While a day trader never holds a trading position for more than one day. Usually day traders choose timeframes from 1 minute to 1-hour charts to do the analysis. Peoples who are impatient and newcomer traders chose the day trading styles to book a little amount of market movement with big lot sizes and higher risks. This approach in many times leads a trader to take big losses by consistently hitting the stop loss.

In position trading, traders usually hold a trade position for a very long time. In position trading, traders hold a trade position even for several years. Mostly the banks, financial institutions, and big money boys’ likes to trade this way. This types of trading need a lot more capital than any other trading styles, because the stop loss here is quite large, and a position trader usually analyzes the market charts in higher timeframes like weekly to monthly charts.

But in swing trading, traders try to detect the beginning of a trend or wait for the trend continuation points to form to enter in a trade and ride along with the market momentum. Swing traders are also sometimes being referred to as momentum traders. In swing trading, traders usually choose timeframes from 1 hour to daily charts to analyze the market momentum and holds a trade position for more than 1 day.

On average, a swing trader holds a trade position for a couple of days to a couple of weeks depending on the timeframe and trends longevity. In swing trading, the stop loss size is much smaller than the position trading since a swing trader trades at the trend continuation point and holds a trade position for a few days which ensures maximum profit and lesser risks when swing trading the stocks, Forex or any other financial assets.

Why Swing Trading is the best and how to swing trade?

In my over 8 years of trading experience, I never found a trading style more than profitable and reliable than the swing trading. Swing trading gives flexibility in proper money management and as well as time management for traders who are busy in their daily jobs and businesses.

It does not require larger capital or so much time to analyze the market to make successful trade entries and exits, while a day trader or scalper needs so much time and effort to trade as they actively try to find trade setups in lower time frame charts. But a swing trader does not need to take so much stress while swing trading.

There are many swing trading strategies out there, and some of the swing trading strategies work very well if a trader can implement the strategy with proper money management and trade discipline. Although there are many swing trading strategies can be found developed by various professional traders, but the core principle or main steps of swing trading is always the same.

No matter if you want to learn how to swing trade stock or how to swing trade forex or any other financial assets, the basic is always the same.

So what are the main steps in swing trading?

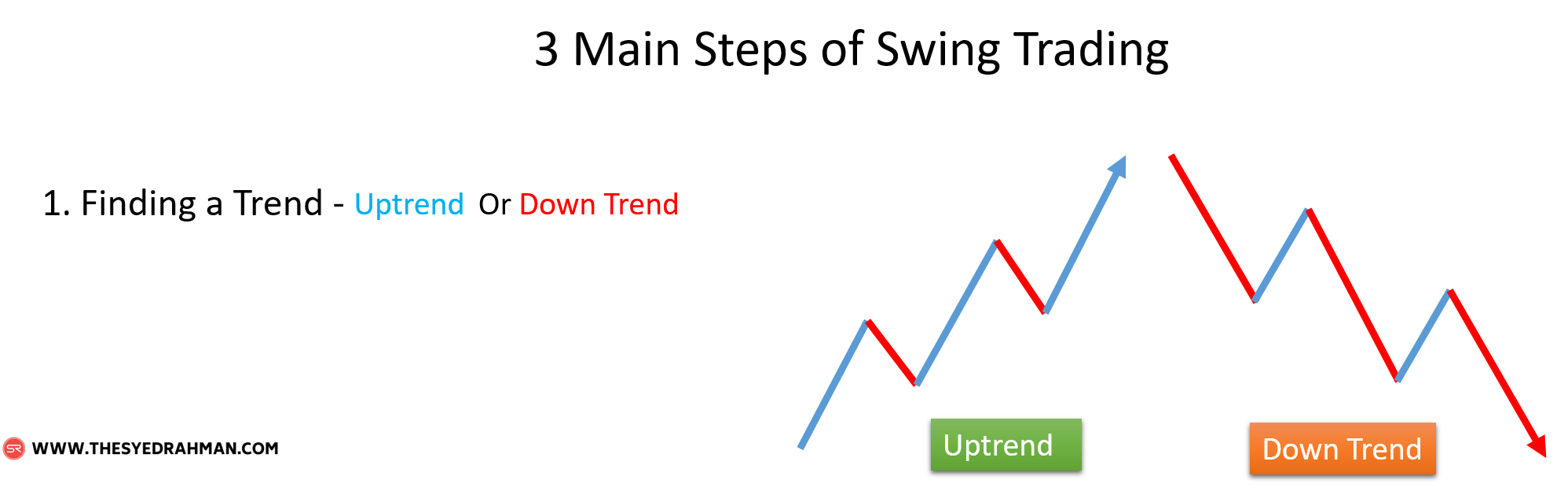

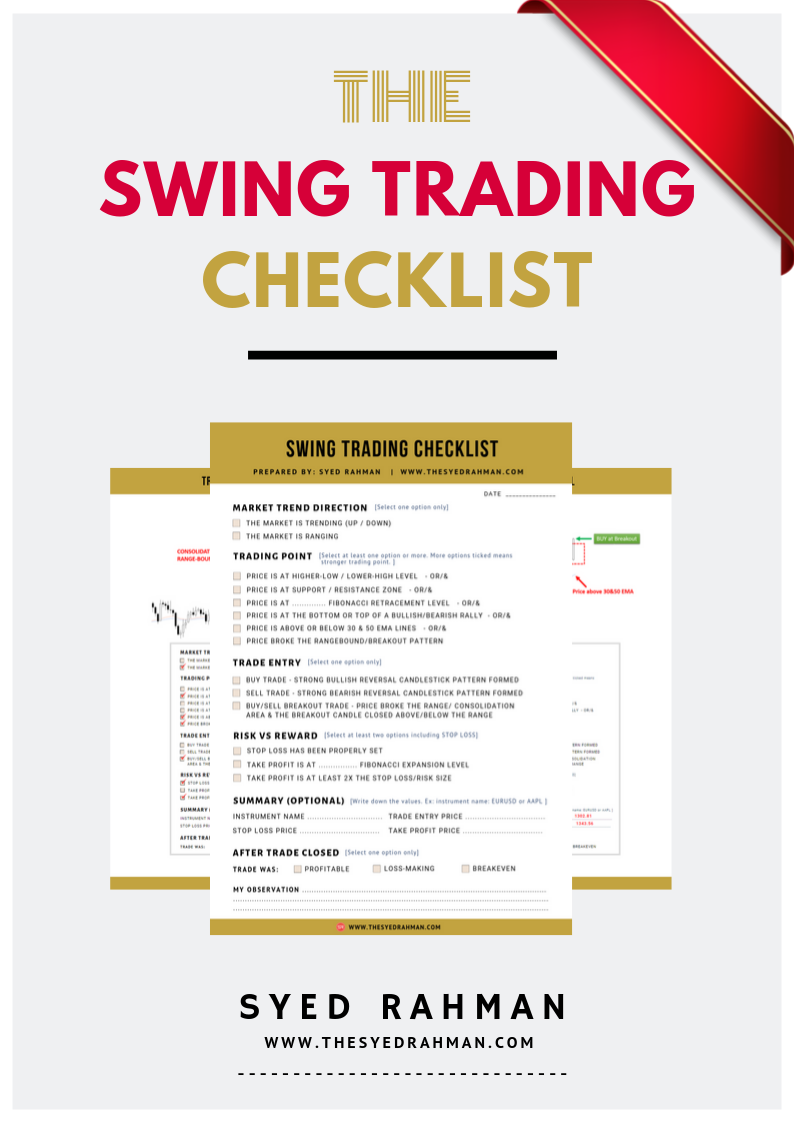

To trade the valid swing points, a swing trader focuses on 3 main steps to ensure potential and most profitable trade entry points. Below I am going to briefly discuss these three main steps in swing trading which I teach in my ‘ADVANCED Swing Trading Strategy’ course.

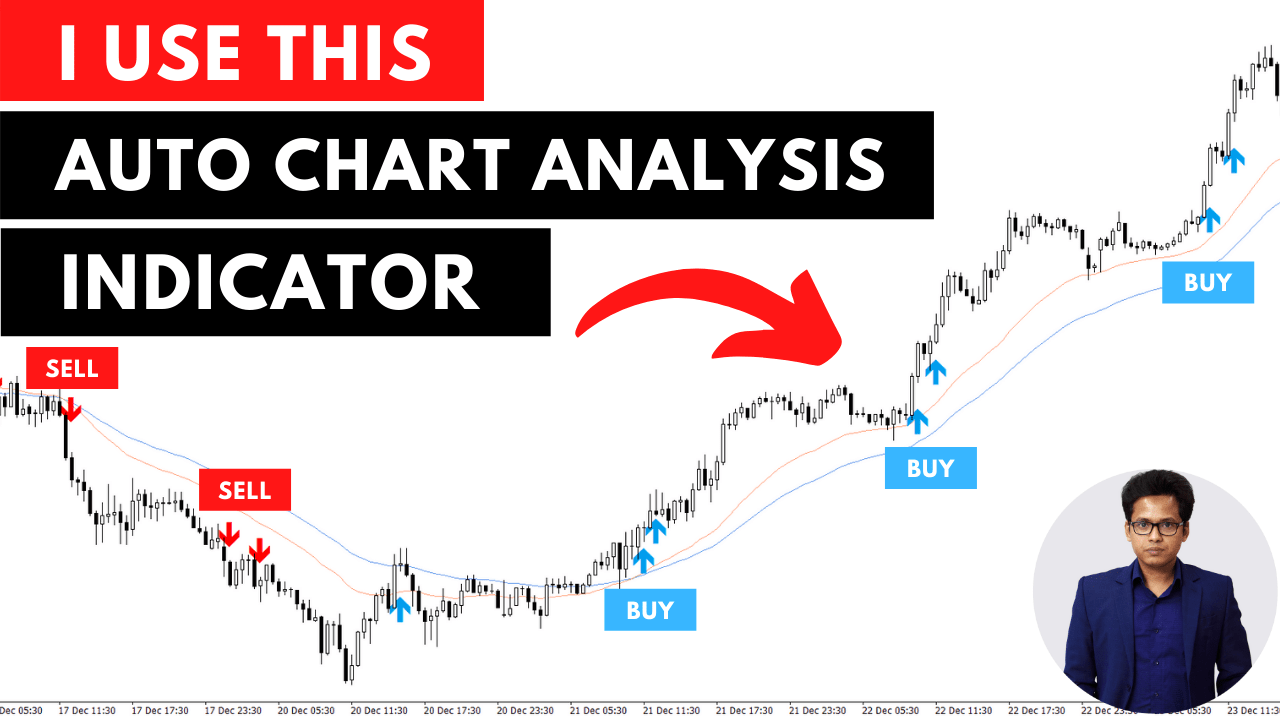

1st Step – So, the first step in swing trading is to finding a trend, either it’s an uptrend on a price action chart or a downtrend in a price action chart. Identifying a trend is the main criteria to trade the swings of a trend. You can use momentum indicators such as moving average indicator to have a clear visual of a trend and its momentum, although a moving average does not signal you the formation of a trend when it just started to form. It has some other grammatical methods to identify a trend and ride on the trend before other trader notices its formation.

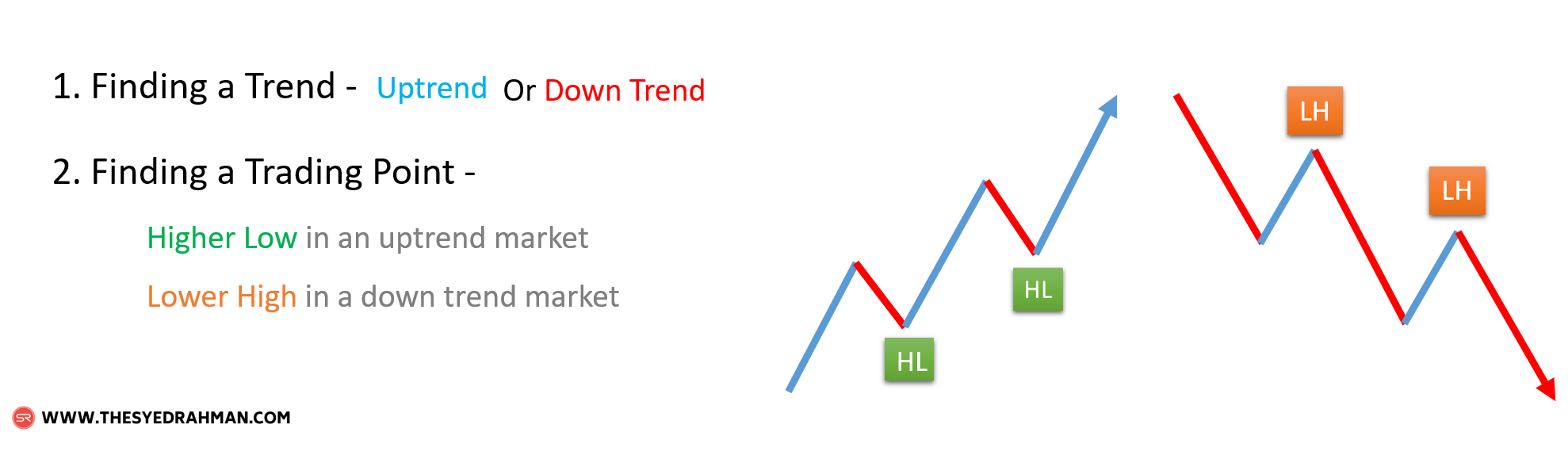

2nd Step – The 2nd step is to finding valid trading points on that trend. That means finding the higher low points in an uptrend market and lower high points in a downtrend market. In swing trading, the higher low levels are the swing low levels in an uptrend, and the lower high levels are the swing high levels in a downtrend market. The higher low (HL) levels are the trading points in an uptrend market, and Lower high (LH) levels are the trading points in a downtrend market.

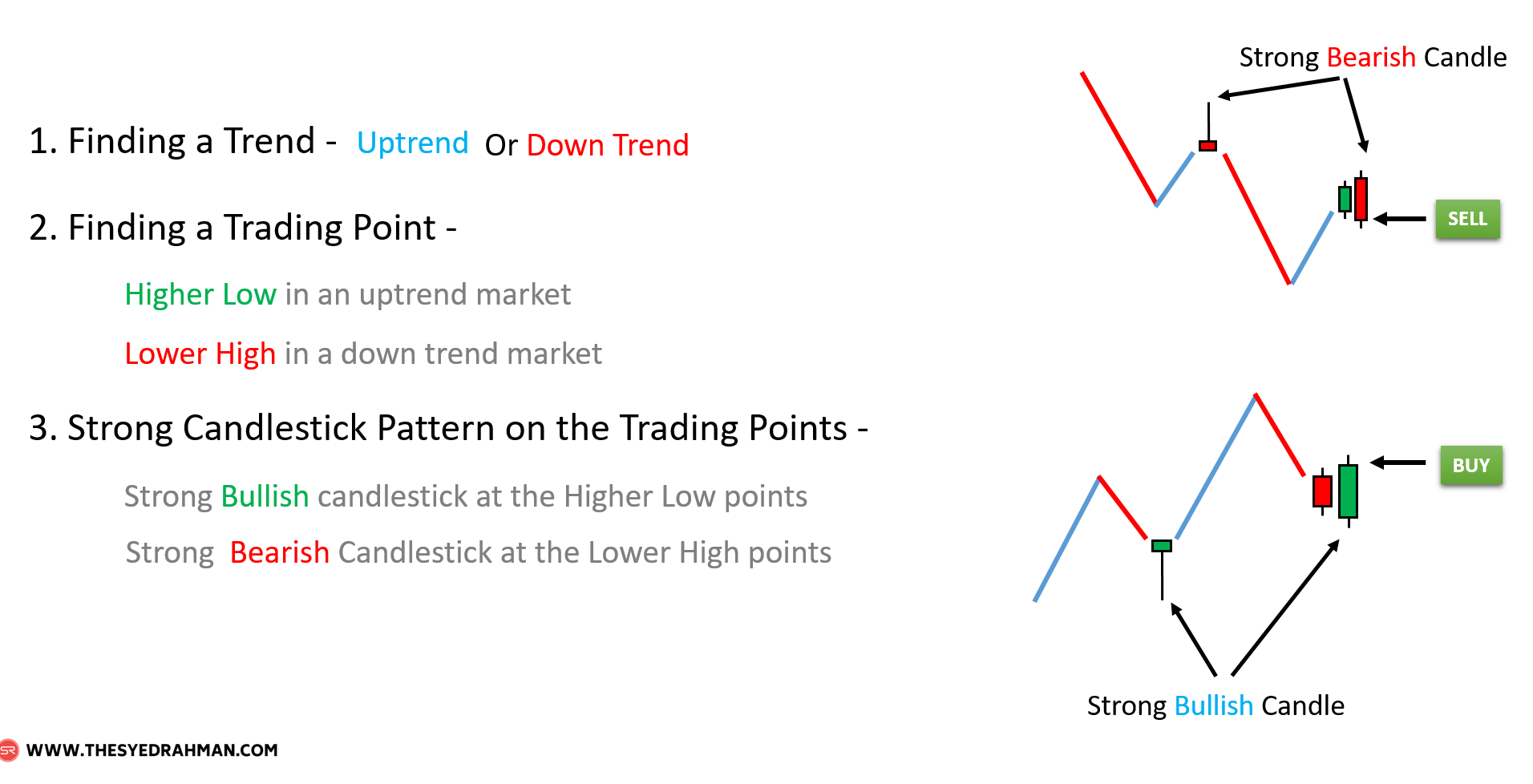

3rd Step – And the 3rd step is to finding strong reversal candlestick pattern at the trading point of a trend. That means to search a strong bullish candlestick pattern on the higher low point in an uptrend market that will act as reversal pattern, like the bullish pin bar pattern, or the engulfing candlestick pattern, or any other strong candlestick patterns, so that we can confirm the end of the running bearish momentum and have the trade confirmation of the upcoming bullish momentum.

On the same way, search a strong bearish candlestick pattern on the lower high point of a downtrend market. A strong bearish candlestick pattern on the lower high levels of a downtrend market indicates the end of the market correction/reversal or the end of bullish momentum on that downtrend, and hence predicts the upcoming bearish market momentum, which we intend to catch as early as it possible.

So these are the three main steps to trade in a trendy market. This types of trade setup carry the highest level of chance to win a trade.

Because when you trigger a trade entry by following these three steps, then that means, you have triggered your trade in the direction of the running trend, so you are actually trading with the majority of the traders on that market. The trade in the trading point makes sure that you have triggered your trade from the very beginning of the push from the retracement level so that your stop loss becomes small and the take profit level becomes very large.

And then finally a strong candlestick pattern gives you the confirmation of the end of the retracement and hence indicates that the market is going to move in your trading direction. So these are the steps you should always keep in your mind, whenever you are going to trade in a trendy market.

The above-explained swing trading strategy is the very basic yet very powerful method of swing trading the Forex or Stocks. If you want to learn more details of swing trading the stocks, swing trading the forex or any other financial assets, then you can enroll in my ADVANCED Swing Trading Strategy course, the course that teaches everything about swing trading.

ADVANCED Swing Trading Strategy (The Course)

This is the same swing trading strategy that I am using successfully for over 8 years to trade the Forex and stocks. In this course, I teach my students all the best tips and techniques to successfully trade any financial markets. Over 4000 students have been already joined the course from 128 countries worldwide!

What are some of the major topics that have been taught in the strategy?

Below are some of the major topics that I have covered in the course to make it the best swing trading strategy ever!

• Understanding the Demand and Supply theory in terms of investment trading.

• Implementing the Demand and Supply theory with the Support and resistance levels.

• Distinguishing the most important VALID and INVALID tops and Bottoms.

• Identifying the SWING POINTS which is necessary for Trend Trading.

• Understanding the proper risk and reward ratio model to scale the profit sizing.

• The Basic model of Swing Trading Strategy – Simply detect a trend with bare eyes and trade the trend like a pro!

• ADVANCED Swing Trading Strategy with more deep insights to detect a trend at the very early stage of its formation, and the most probable strategy to trade the trend.

• Filtering the trade entries and exits to get maximum profit and minimum risks while swing trading forex or swing trading stocks.

• Complete understanding of Fibonacci numbers and ratios to determine the retracements, extensions and more to target the most probable profit level using the appropriate risk and reward ratio model.

• Magic moving averages to identify the most probable Swing Points or Trading Points of a trend.

• Trading the invalid Swing Points of a trend with our ADVANCED Swing Trading Strategy.

• Time-frame Analysis to get better result of the Strategy and make maximum profit.

• And some other relevant things to master the world’s most trusted, profitable and best swing trading strategy to trade successfully – and turn yourself a consistent trade winner in forex, stocks, and other investment markets.

What our existing students said about this course:

“This is the Swing Trading course you need. This is probably the first time that I’ve understood a swing trading strategy which is simple and effective. I’ve encountered a lot of confusing strategies over the last year and this course has helped my confidence in executing swing trades. Simple, well explained, easy to apply. Thanks for this course.” – Vincent Roy Yup

“I will HIGHLY recommend this course. This is the BEST course I have taken and I learned so much. The instructor is absolutely great teacher, with a lot of examples and very very detailed explanation. He’s the best. My trading has improved a lot, and I can read price action chart like the pros do. Thank you so much sir. I appreciate you make this course available.” – Paul Omasere

“I have taken a number of Forex courses and whilst most are detailed they don’t always provide easy to follow trading strategies. This swing trading course gives you what you need and emphasizes that too many indicators will only confuse you and make it harder to find a trade with proper entry. I enjoyed the explanation on determining a valid or invalid swing point and the many examples on how to trade off moving averages of the fibonacci indicator. Swing trading I feel gives traders more consistent returns than breakout trading which may give higher winning trades but less of them. I do recommend this course to other Forex traders.” – John Mandich

“It’s a must ( if you are serious ) to do this course , in my opinion it’s the best course available on swing trading that’s out there , Syed’s lectures have a clear & systematic approach to understanding the foundational principles of swing trends & trade placement , you get a real candlestick / MA lines understanding , learn the beauty of applying Fibonacci to the mix & it’s designed not only for the novice but the pro as well , forget youtube hacks , & learn from a real trading educator , Syed Rahman is the man , peace out , Mike from Perth Aus !!” – Micheal Mccoy

In short, to trade the market as a price action trader, to me swing trading is the only trading strategy that allows to ensure minimum risk and maximum profit from any investment market.

So, click the link below and go to the course landing page, read the description, course curriculum and student reviews to get better understanding of this course.

Hurry up before the seats get filled up!

Click here to learn more about the course bundle: https://www.thesyedrahman.com/revcan-indicator-swing-trading-strategy-master-course/

Interesting. Thanks for sharing this knowledge.

Thanks for reading. 🙂

Awesome article Mr. Syed. This is how I trade and you explained it very well. My meaningful knowledge came from trading while observing live charts, then researching my observations. This article of yours confirms my strategy. The beauty of this strategy is it’s flexible, can be used for scalping, short – long term trading, etc.

Thanks Tinoy. Yes you are right, the price action concept of swing strategy is so dynamic that it can be used to even day trade the market.